EDITORS' PICK

Taisei-Yuraku developing apartment building in Otsuka

Chuo-ku's Taisei-Yuraku Real Estate will construct a rental apartment building with a retail space in Minami-Otsuka, Toshima-ku. Construction will start in June 2024, with completion targeted for March 2027.

GLP J-REIT to acquire replacement asset for fire damage

Loadstar acquiring six resort hotels

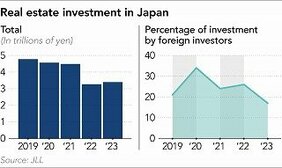

Japan land prices rise most in 33 years, but foreign investors shy away

JR East subsidiary acquires Shibuya building from German fund

Nippon Life Insurance acquires part of Otemon Tower

Shochiku acquires two Ginza office buildings from Angelo Gordon

Mitsui enters U.S. logistics business, investing up to Y68bn

Sumitomo Mitsui leasing firm to buy Singapore private funds for $270m